Jonathan Kuminga the Trade Candidate: What You Need to Know

The Warriors will have another chance to trade Jonathan Kuminga. I go over when he can be traded, what is required from other teams, and limitations the Warriors face.

Last week, we finally received clarity on the 2025 offseason’s longest standoff when the Warriors and Jonathan Kuminga agreed on a two-year, $46.8 million contract, with a team option for 2026-27. It came a day ahead of the expiration date of his $8 million qualifying offer. Letting it expire would’ve relinquished his last remnant of leverage back to the Warriors.

Two months ago, Third Apron analyzed the top remaining restricted free agents with a focus on Kuminga and the Warriors. The timeline was emphasized since this was expected to go down to the last minute.

The signing of Kuminga came a day after agreements with Al Horford, De’Anthony Melton, Gary Payton II, and Will Richard were reported. These signings were long rumored and became an open secret the longer the offseason dragged out. The Warriors held off on announcing them to prevent another team from giving Kuminga an offer sheet they couldn’t match.

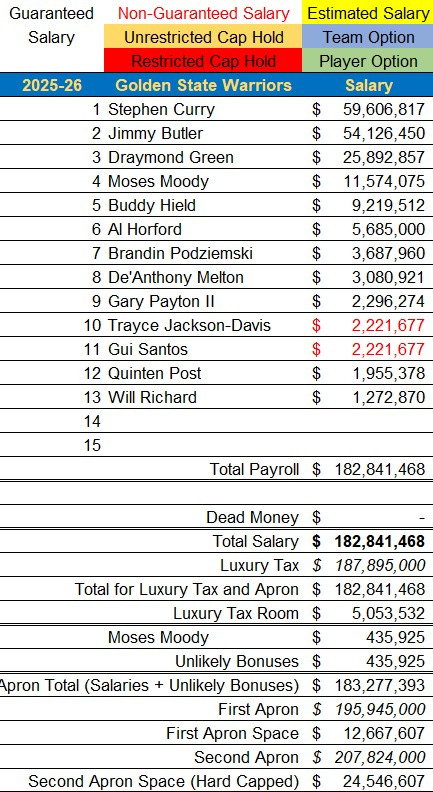

The Warriors signed Horford to a two-year, $11.7 million contract with the taxpayer mid-level exception. That signing hard capped them to the $207.8 million second apron. The respective minimum salary cap hits for Melton ($3.1 million), Payton II ($2.3 million), and Richard ($1.3 million) would leave them $24.5 million below the second apron hard cap. The Warriors wouldn’t be able to match an offer sheet that is $1 more than that amount.

That scenario was highly unlikely to happen, especially this late into free agency, but they couldn’t leave the opportunity open. The Nets are the only team currently with cap space, but, as we saw with the Bucks this offseason, another dark horse team could reduce its salary enough to get in the mix.

It wouldn’t take much effort for a team interested in Kuminga to create the flexibility to sign him. For example, the Jazz could have close to $19 million in cap space if they renounce all their exceptions. They could get to $26 million if they waive and stretch Kyle Anderson, reducing his salary from $9.2 million to $1.8 million cap hits over the next five seasons.

Bottom line, the Warriors wanted to re-sign Kuminga to a contract with a starting salary in the low $20 million range. This would allow them to fulfill their roster goals within the second apron while enabling Kuminga to become a significant salary ballast in a potential trade for a new starter.

So what do we need to know? First, the basics. Kuminga will become trade-eligible starting on January 15, 2026. Recent free agents usually become trade-eligible on December 15th or on the third anniversary of the signing, whichever is later. However, his date is January 15th since he was a free agent with full Bird rights who re-signed with his previous team with a starting salary exceeding 120 percent of his previous salary.

Kuminga received a 15 percent trade bonus that would be worth, at a minimum, $1.3 million. That’s the amount he’d receive if traded on the trade deadline. He’d receive $1.7 million if traded on January 15, which would increase the total value of his contract to the originally reported $48.5 million amount.

Most teams in the league, who operate below the $195.9 million first apron, would need to send out $14 million to match Kuminga’s $22.5 million salary. The increased cap hit as a result of his trade bonus would require most teams to send out a little more than $15 million, depending on which day he’s traded on.

Also, Kuminga waived his right to veto trades this season. Players who re-sign with their teams on either a one-year deal, or a two-year deal with an option on the second year, can veto any trade since agreeing to one would reset their Bird rights to Non Bird. This takes away his agency toward a potential destination, but the loss of Bird rights won’t impact his earnings.