Jrue Holiday for Anfernee Simons Trade Mechanics

I explain how the trade works for both perspectives and detail how the Celtics save $41 million against their luxury tax bill despite only reducing their payroll by $4.7 million.

The Boston Celtics have officially begun their journey out of their financial apocalypse. They made a small step last night by agreeing to trade Jrue Holiday to the Portland Trail Blazers for Anfernee Simons and two second-round picks. They went from potentially having to attach assets to get off Holiday’s remaining three years, $104.4 million, to getting positive value in return.

This trade can be processed in the 2024-25 league year. It works for Boston now despite being above the second apron because they are decreasing their payroll. They will create a $4.1 million trade exception, which is the difference between Holiday’s $30 million salary and Simons’ $25.9 million salary.

They can use it even if they remain above the second apron in 2025-26. The aprons only restrict teams from using trade exceptions created in the previous season. However, they are unlikely to use it since they’re looking to save more money.

Portland is using an expanded trade exception to acquire Holiday. They need to get within $7.8 million of his $30 million salary in the 2024-25 season. Simons’ salary alone is a salary match, so they don’t need to send anything else. They just need to make sure they don’t exceed the 2024-25 $178.1 million first apron, which they are now hard-capped to. They do just that, staying just $5.4 million below that threshold.

The Blazers are also now hard-capped to the $195.9 million first apron in the upcoming 2025-26 season. They are $13 million below that threshold, but more relevant is the luxury tax. They are $6.6 million below that threshold with 14 players rostered and are not expected to exceed it this season.

This is a strange trade from the Blazers. In theory, adding a defensively-minded veteran like Holiday fits their identity. They made a late push toward the Play-In Tournament last season upon starting Toumani Camara and Deni Avdija together, along with Donovan Clingan, who is already one of the league’s most underrated rim protectors.

But Holiday is 35 years old and on a contract that the Celtics had no choice but to sign him to after trading two first-round picks for him. It seemed unlikely that they’d have to attach an asset to get off him, and instead, they’d get neutral value if there were enough suitors. Turns out there was enough of a bidding war for the Blazers to need to include Simons and two second-round picks to acquire Holiday.

Holiday makes more sense now to the Blazers than the Celtics, but he probably makes more sense to a bunch of other teams over the Blazers. The Clippers, Mavericks, and Rockets would’ve been great spots for him. According to Jared Weiss, the Kings and Raptors were also interested. The Blazers weren’t even in the top five of most people’s lists for Holiday destinations, which already should be a red flag.

The Blazers were always going to make a significant move like this involving their expiring salaries. They were in a position to have north of $50 million in 2026 cap space after factoring in an extension for Shaedon Sharpe. They’re more likely to make upgrades by trading their expiring contracts now.

They still have another move to make with $60 million in expiring salaries between Deandre Ayton, Robert Williams, and Matisse Thybulle. They also could trade up to four first-round picks to sweeten their offers, including the 11th pick in Wednesday’s draft. They have enough tax flexibility in 2026-27 to take on more long-term money akin to the Holiday acquisition. Expect them to be aggressive for another impact player this summer.

The Celtics only reduce their payroll by $4.7 million by going from Holiday to Simons, but decrease their tax penalty by $41 million. That equals nearly $46 million in total savings while factoring in a salary for the 32nd pick. They are still $20 million above the $207.8 million second apron with 14 players.

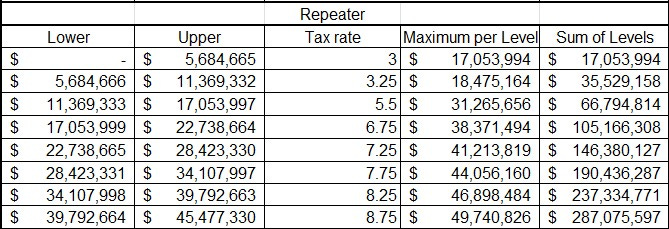

The Celtics were projected with a $277.4 million luxury tax penalty before making this trade. It’s so high for a couple of reasons. The first is their high proximity above the luxury tax line. They were $44.4 million above that threshold, putting them in the eighth luxury tax level. Teams between $39.8 million and $45.5 million above the tax in 2025-26 must pay $6.75 per $1 as well as an additional $157.7 million for exceeding the previous seven tax levels.

However, that’s just for standard taxpayers. The Celtics entered the repeater tax this season because they were in the luxury tax in three consecutive seasons. Teams in the luxury tax in three of the previous four seasons must pay an additional $2 per tax level. This is a new change from the 2023 CBA being implemented this upcoming season.

So instead of paying $6.75 per $1 above the tax, they’d pay $8.75 per $1. And instead of paying $157.7 million for exceeding the previous seven tax levels, they would pay $237.3 million instead.

The Celtics weren’t going to pay $8.75 per $1 for all $44.4 million above the tax. They would only be paying that much for the $4.6 million above $39.8 million, the lowest end of the eighth tax level. That means they were set to pay $40.1 million just for the $4.6 million in the eighth tax level.

Combine that $40.1 million with $237.3 million for maxing out the previous seven levels, and you’ve got a $277.4 million penalty. That illustrates just how punitive the new luxury tax system is, in addition to being a repeat taxpayer.

But the flip side to that is that teams deep in the tax get substantial savings just by reducing their payroll by a few million. That’s why the Celtics save $41 million by trimming just $4.7 million in this trade. They are eliminating the $40.1 million portion of the eighth tax level just by getting out of it.

Expect the Celtics to make more trades to create more savings. As mentioned in the Celtics offseason preview, they should get below the second apron and potentially the luxury tax line by making multi-team trades. This would give them a greater chance at taking back lower salaries without needing to attach assets.

For example, this trade can be expanded to include a third team acquiring Simons. Teams below the first apron only need to send out $19.2 million to acquire him. The Celtics would save an additional $78 million against their payroll and luxury tax by taking back a $19.2 million player instead of Simons.

Simons is a nice young player, but it’s unclear if he projects to be in the Celtics' long-term plans. He can extend for up to three years, $104.6 million, but they’re likely to play things out with him into the season. They’re in a position to be well below the tax and aprons in 2026-27 if they let his contract expire.

Kristaps Porzingis seems like a strong candidate to be moved, while Derrick White would likely require an overpay for the Celtics to consider moving him. They could also trade Sam Hauser, whose $10 million salary can fit in teams’ $14.1 million non-taxpayer mid-level exception.

You can also see me on:

CapSheets.com to view all my salary cap data,

Twitter and BlueSky for instant transaction analysis,

and YouTube for more cap analysis and conversations with guests!

Looking at Porzingis. If the Hawks were to offer Niang/Mann for Porzingis, this would both be legal under the cap, and save the Celtics ~55M in tax payments, if I have that right?