Why the Celtics May Duck the Luxury Tax Both This Season and the Next

The Boston Celtics summer of savings continued this week with the Georges Niang trade. I wrote about their quest to get under the luxury tax in 2025-26, and why it could extend into 2026-27.

The Boston Celtics' summer of savings continues. Remember, they came into the offseason with over half a billion dollars in payroll and luxury tax on their roster. They couldn’t justify spending that much, especially with Jayson Tatum set to miss the 2025-26 season with an Achilles injury.

They began by trading Jrue Holiday for Anfernee Simons, a move that gave them $46 million in savings. They followed that up by trading Kristaps Porzingis for Georges Niang. Those two moves combined cut the Celtics' roster expenses in half.

Then, earlier this week, they traded Niang to the Jazz, along with two second-round picks, for two-way player RJ Luis. The move saved them an additional $50 million in payroll and luxury tax penalties. After signing Chris Boucher to a one-year, minimum contract, they project with a $238 million roster.

While the Celtics have reduced their tax penalty to a reasonable amount, they’re likely not done. They are just $4 million above the first apron. Getting below it would free them of several roster-building restrictions. For example, they’d be able to take in more salaries than they’re sending out in a trade and open up to $14.1 million non-tax mid-level exception.

More importantly, the Celtics are $12.1 million above the $187.9 million luxury tax line, which is impressive considering they started the season over $40 million above that threshold. They appear set on avoiding the luxury tax altogether. Their savings are likely the result, rather than a way to open up more spending.

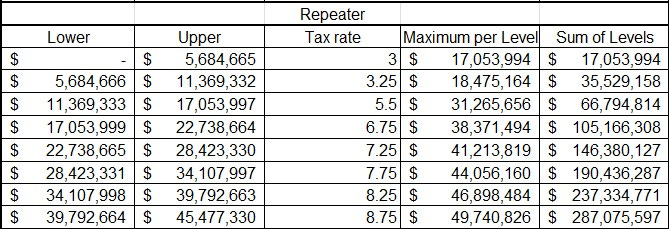

The reason the Celtics were projected to have a $500+ million roster is that they entered the repeater tax. That is a designation given to teams that are taxpayers in three of the last four seasons. They were taxpayers in the previous three seasons, so now they must pay higher rates.

2021-22: Non-taxpayer

2022-23: Taxpayer

2023-24: Taxpayer

2024-25: Taxpayer

2025-26: Repeat taxpayer

The repeater tax system was modified in the 2023 CBA, and the changes are taking effect this upcoming season. It’s more punitive for teams in the third tax level or above. Not only do repeat taxpayers have to pay higher levels the deeper they are in the tax, but they also now pay $2 extra per level than standard taxpayers.

The Celtics entered the offseason at the eight luxury tax level, which gave them a floor of $237 million in tax penalties. They are now slightly above the third level, leaving their current projected penalty at just under $40 million. As a result, they’ve saved nearly $290 million in roster expenses since the start of the offseason.

The punitive system and the heavy expenses at all tax levels motivated the Celtics to save money by tearing down the roster. This isn’t necessarily a signal that they won’t be competitive this year; they have a case to be in Play-In territory in a weak East. Although they might not be upset about getting a lottery pick in a year they’re not expected to be championship contenders.

However, getting under the tax in 2025-26, and likely 2026-27, would be a major step toward contending again. That’s because they’d get out of the repeater tax starting in 2027-28.